africanspur

Full Member

- Joined

- Sep 1, 2010

- Messages

- 9,846

- Supports

- Tottenham Hotspur

She's a member of LDS according to her profile, and those nutters are truly nuts up in religion.

Hasa Diga Eebowai!

She's a member of LDS according to her profile, and those nutters are truly nuts up in religion.

They've been doing it at the state level for a long time without any personal career consequences. Never doubt the stupidity and laziness of the American public.

I feel for Spicer. Brutal job.

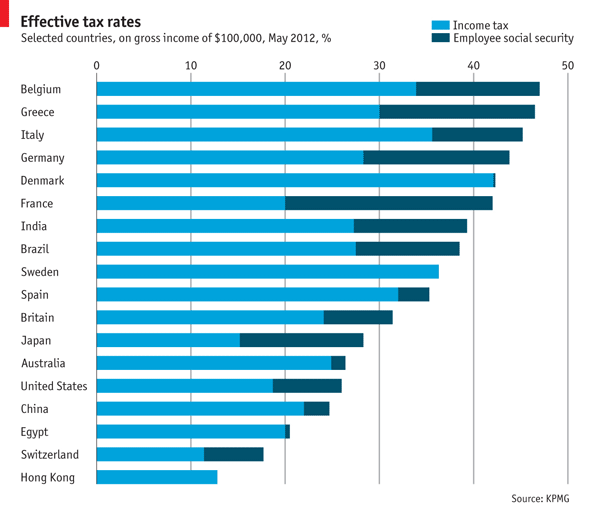

A slightly outdated (2012) attempt:

On a side note... am I the only maniac that who would be tempted by the idea of going without insurance?

He's supposedly a nice guy. Supposedly... (I really like that word...).I feel for Spicer. Brutal job.

This group voted 70% Trump. Something doesn't add up.

Because people are too lazy to educate themselves.

A 2014 Kizer study found...

http://kff.org/health-costs/report/2014-employer-health-benefits-survey/

Say you make $100,000 a year combined as a family, that's putting you spending nearly half your income on taxes and healthcare.

The argument against universal healthcare using "higher taxes" becomes void imo when you actually look at the numbers.

The tax rate at married filing jointly with a $100,000 income is "$10,367.50 plus 25% of the amount over $75,300".

I'm curious to know what tax rates are in your countries so I can compare the tax payment + insurance payment to what you're getting.

Be nice! SAD!

Yes, it's hard to give like for like because we get so little in return for our tax dollar compared to what you'd get in Germany.I do not think that is so easy to compare - because even for your tax dollars you get a different package in every country.

A mate of mine went to the states two years ago and stepped on some kind of nasty sea creature (a sting ray or something) and got stung under his foot. Took a taxi to the hospital, removed the stinger and closed the wound with a couple of stitches. In and out in a couple of hours, not a big deal

There was some problem with his insurance though (he had travel insurance, but the hospital did not want it or some shite) and the hospital bill was something like 20,000$. His insurance covered it in the end though, but that's an obscene amount of money for something like that.

And as someone else said, for us Europeans it's unfathomable how the Americans view healthcare as a privilege and not a right. Owning a gun on the other hand is a right

The ironic thing is though, the US spends A LOT on healthcare in general, so it's not just an unfair system, it's also woefully ineffective.

I am on the record to criticize the US healthcare system here, so it is just fair to add something to balance these graphics about prices: The US health-care sector is by far the most innovative one in the world and other countries benefit from this, while US consumers have to pay for a disproportionately high share of the costs.

agreed on both points. Still have my 5d even after I had to do a shutter change. legend camera.I still have one and often use it. One of the iconic camera's in photography history.

Canon 85mm L is arguably the best portrait lens ever made. perfect for microwave reconnaissance photography!

Be nice! SAD!

The Threat from Federal Debt

Donald Trump railed against rising government debt on the campaign trail, but we don’t know yet how he will tackle the problem as president. The debt lurks behind many issues on his plate, including Obamacare repeal, tax reform, defense spending, the border wall, and his upcoming budget. A vote on the statutory debt limit is also coming up.

Trump faces tough choices because President Barack Obama left him with a fiscal mess. A river of red ink under President George W. Bush turned into a torrent under Obama. Federal debt held by the public soared from $5.8 trillion in 2008 to $14.2 trillion in 2016. As a share of gross domestic product (GDP), the debt almost doubled from 39 percent to 77 percent.

Today’s debt-to-GDP ratio is the second highest in U.S. history, and the Congressional Budget Office (CBO) expects it to keep on growing, as shown in the chart. Only the debt load during World War II was higher.

d from 106 percent of GDP in 1946 to just 56 percent in 1955. You might assume that frugal budgeting by centrist Presidents Harry Truman and Dwight Eisenhower diffused the debt bomb, but that was not the case.

Economists Joshua Aizenman and Nancy Marion found that about four-fifths of that post-WWII drop was due to inflation. By running inflation, the government reduced the real value of outstanding debt and imposed losses on creditors. The government was able to swindle creditors because the average maturity of its debt at the time was a lengthy nine years.

As for frugality, there wasn’t any. The government ran deficits in six of the ten years from 1946-1955. On domestic programs, Truman and Eisenhower were big spenders. We haven’t had an extended period of frugal governance since President Calvin Coolidge was in the White House in the 1920s.

From 1791 to 1929, the government balanced its budget 68 percent of the years, which is why debt fell after the wars in that period. But from 1930 to 2017, the government has balanced its budget just 15 percent of the years, which is why we are in such a fiscal pickle today.

Today’s high debt is much scarier than the WWII debt for a number of reasons. First, the government won’t be able to make the debt disappear with inflation so easily this time, even if that were a good idea. The average maturity of Treasury debt today is much shorter than it was after WWII.

Second, the underlying cause of today’s high debt is not a one-time crisis like a war. Instead, it is a chronic pattern of failure by politicians to control spending growth across many programs. Federal politicians have the legal ability to borrow and spend without limit, and they have proceeded to abuse the hell out of that privilege.

Finally, the official outlook for debt in the chart is troubling enough, but it is optimistic if the future is like the past. The outlook assumes that discretionary budget caps will hold, but Congress has broken them repeatedly in the past. It includes only current programs and projects, not possible new ones like border walls or new wars. And the outlook does not include another major recession, which would sharply cut revenues and boost spending.

No one can predict the future, but if policymakers were prudent they would work to reduce deficits and debt right now when the economy is growing. But we’ve been running half trillion dollar deficits in recent years, even though we are in the seventh year of expansion.

In a 1932 radio address, Franklin Roosevelt said, “Let us have the courage to stop borrowing to meet continuing deficits. Stop the deficits … Any government, like any family, can for a year spend a little more than it earns. But you and I know that a continuation of that habit means the poorhouse.”

Unfortunately, that exhortation turned out to be just campaign rhetoric, and the era of chronic deficit spending had begun. Today, we really will be headed for the poorhouse unless we find more politicians with the courage to cut.

Yes, it's hard to give like for like because we get so little in return for our tax dollar compared to what you'd get in Germany.

You definitely come out on the good end imo, and the things you included are the exact things that Republicans NEVER show when speaking about higher taxes in European countries.

We're never given the full picture by the right.

do you have any data to support that claim?Taxes being higher in Europe than in U.S is just a myth. If you take all the different taxes that we pay here and add it up, then we are paying much, much more in taxes than in Europe. But you're right, we are getting much less back from the government than in Europe. As I mentioned in another post, the politicians have brainwashed people to such an extent that when it comes to providing for the people, they use the usual line that they don't want to burden the people with additional taxes.

I've tried to do this a few times myself. Lots of different taxes in the USA. Fed, state, county, city are obvious ones. Then start to add ss, Medicare, Medicaid, school tax, house tax, municipal tax, HOA fees (if they include things like snow removal), fees (aka taxes) on phones/TV/internet for things like 911.do you have any data to support that claim?

They played it on morning Joe earlier. But this was all known wasn't it? From months ago.Bannon and his allies have leaked the audio of Ryan claiming he won't support Trump, probably as a preemptive shot before the healthcare law fails.

http://www.washingtonexaminer.com/article/2617280/

Bannon and his allies have leaked the audio of Ryan claiming he won't support Trump, probably as a preemptive shot before the healthcare law fails.

http://www.washingtonexaminer.com/article/2617280/

My paycheck, my property taxes.do you have any data to support that claim?

I am on the record to criticize the US healthcare system here, so it is just fair to add something to balance these graphics about prices: The US health-care sector is by far the most innovative one in the world and other countries benefit from this, while US consumers have to pay for a disproportionately high share of the costs.

A mate of mine went to the states two years ago and stepped on some kind of nasty sea creature (a sting ray or something) and got stung under his foot. Took a taxi to the hospital, removed the stinger and closed the wound with a couple of stitches. In and out in a couple of hours, not a big deal

There was some problem with his insurance though (he had travel insurance, but the hospital did not want it or some shite) and the hospital bill was something like 20,000$. His insurance covered it in the end though, but that's an obscene amount of money for something like that.

And as someone else said, for us Europeans it's unfathomable how the Americans view healthcare as a privilege and not a right. Owning a gun on the other hand is a right

The ironic thing is though, the US spends A LOT on healthcare in general, so it's not just an unfair system, it's also woefully ineffective.

Am I the only one who realized that the Trump wiretapping claim was specifically to take the heat off Jeff Sessions? It seems like we've completely forgotten that he lied under oath.

Am I the only one who realized that the Trump wiretapping claim was specifically to take the heat off Jeff Sessions? It seems like we've completely forgotten that he lied under oath.

They played it on morning Joe earlier. But this was all known wasn't it? From months ago.

My paycheck, my property taxes.

It was known but the audio was just released. Once the healthcare bill fails, Drumpf being the irresponsible coward that he is, will no doubt attempt to deflect the blame by blaming the GOPs in Congress, by way of Bannon's dirty tricks.

There are enough people and money in the system to subsidize or even spread the cost enough so that it doesn't be a burden on the taxpayer. Congress can do this if they wanted to along with getting the states to buy in. The problem in America is that everything must be about profit first.

I didnt forget why did you?

I've tried to do this a few times myself. Lots of different taxes in the USA. Fed, state, county, city are obvious ones. Then start to add ss, Medicare, Medicaid, school tax, house tax, municipal tax, HOA fees (if they include things like snow removal), fees (aka taxes) on phones/TV/internet for things like 911.

Now start to consider the cost of things covered in Europe like healthcare and education.

Difficult analysis!

So we should run the federal budget on the basis of "there's enough", and not the math?

Of course its a burden to the taxpayer. I'm not against expansion of healthcare rights and spend, or insurance in place of. But its disingenuous to say it won't be a burden on the taxpayer.