Denald mate. I know it's hard to tell between the 2 now.

Sunti mate. I know it’s hard to tell between the 2 now.

Denald mate. I know it's hard to tell between the 2 now.

Sunti mate. I know it’s hard to tell between the 2 now.

Because, you know, work!

This should never be called the "Southern White House", it should called what it actually fecking is; a golf course. Any time a media outlet has to mention it, they should say golf course. The President is staying at a golf course.

This should never be called the "Southern White House", it should called what it actually fecking is; a golf course. Any time a media outlet has to mention it, they should say golf course. The President is staying at a golf course.

Putin's office is any room he wants it to be. Like that bad guy in Sherlock who pissed in the fireplace. Might be another reason why Trump likes him.You know who else has two residences of power? Russia.

You know who else has two residences of power? Russia.

Putin's office is any room he wants it to be. Like that bad guy in Sherlock who pissed in the fireplace. Might be another reason why Trump likes him.

checkmate trump

Oh hey it's Eboue. Thanks for the input. Now, here, please take this propeller hat - that's yours to keep Eboue, all yours - and go and ask those nice folks over there if they would like to see your impression of an airplane. Yes, those ones over there. Now, once you're done with that don't forget to recount the number of grains of rice in the bag - very important work, Eboue, no idea what we'd do without your help - it's important that we know exactly how many grains are in there otherwise the pudding is going to be too runny. Yes, that's right, off you pop and we'll see you in a few hours. That's a good lad, we're so very proud of you.checkmate trump

Oh hey it's Eboue. Thanks for the input. Now, here, please take this propeller hat - that's yours to keep Eboue, all yours - and go and ask those nice folks over there if they would like to see your impression of an airplane. Yes, those ones over there. Now, once you're done with that don't forget to recount the number of grains of rice in the bag - very important work, Eboue, no idea what we'd do without your help - it's important that we know exactly how many grains are in there otherwise the pudding is going to be too runny. Yes, that's right, off you pop and we'll see you in a few hours. That's a good lad, we're so very proud of you.

You can have mine. Pexbo gave me it when I wouldn't stop making fake Trump tweets.do i get a lolly when im done?

Zinke out. DeVos to follow soon. What's happening?

Mick Mulvaney. Extreme irritant.

DeVos has managed to lay low enough to stay in the job. Unsurprisingly, Price, Pruitt, and Zinke - the worst of the lot, are all gone.

I thought SC already ruled that it was fine with constitution?

The new budget (or maybe tax bill) includes a provision that the individual mandate no longer exists, according to the judge this invalidates ACA (maybe with the exception of the Medicaid expansion, I don't know)

PART VIII--INDIVIDUAL MANDATE

SEC. 11081. ELIMINATION OF SHARED RESPONSIBILITY PAYMENT

FOR INDIVIDUALS FAILING TO MAINTAIN MINIMUM ESSENTIAL COVERAGE.

(a) In General.--Section 5000A(c) <<NOTE: 26 USC 5000A.>> is amended--

(1) in paragraph (2)(B)(iii), by striking ``2.5 percent' and inserting ``Zero percent'', and

(2) in paragraph (3)--

(A) by striking ``$695'' in subparagraph (A) and inserting ``$0'', and

(B) by striking subparagraph (D).

I read it carefullyWaiting for Santi...

The Democrats are coming with insight committees.Zinke out. DeVos to follow soon. What's happening?

You know who else has two residences of power? Russia.

I don't think these things matter anymore.

See: Ted Cruz.

He’s on a tweet storm today.

Doesn't he like Alec Baldwin?

SNL should do a re run of it over the holidays. Just to piss him off. Though he ll probably see it as a compliment.Does he forget that he hosted SNL during the campaign?

To be fair Alec Baldwin is a twat

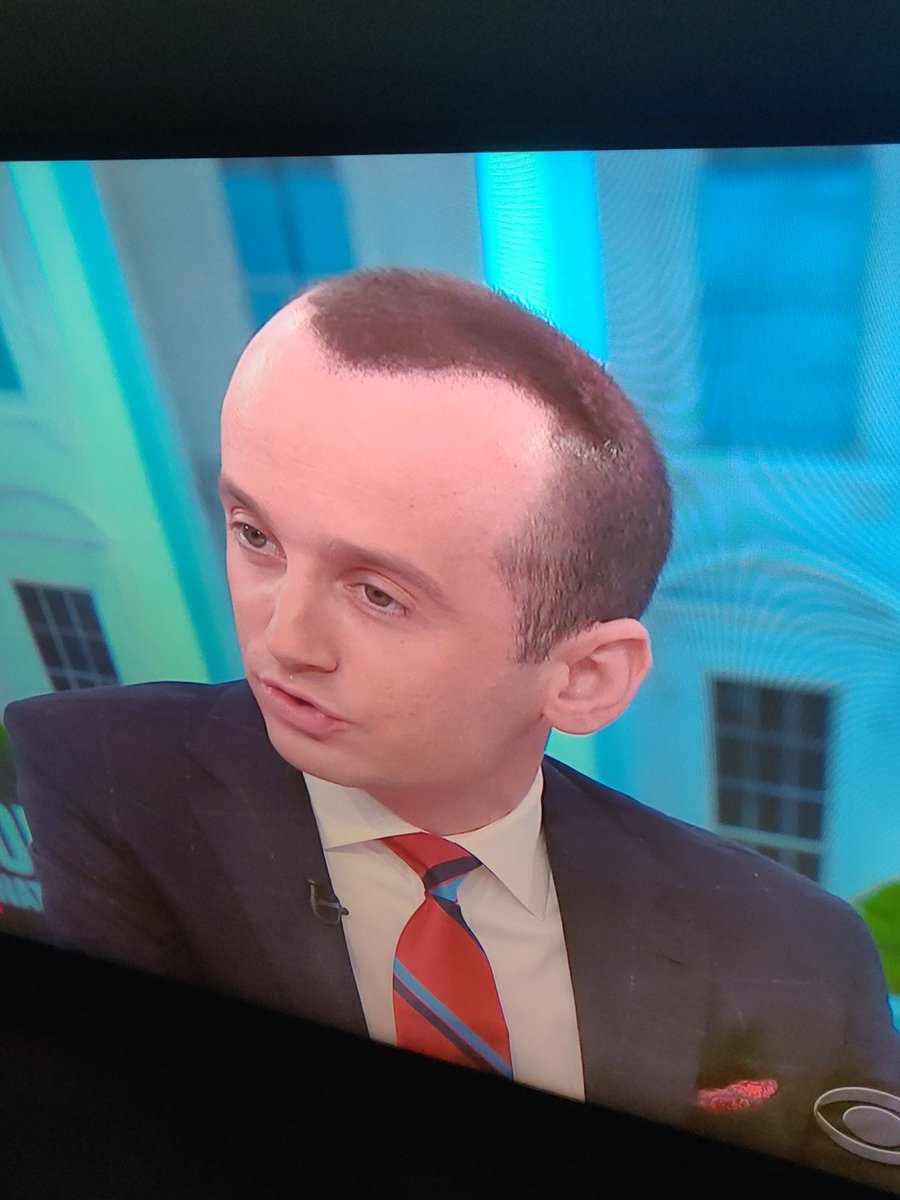

What a convincingly thick head of hair Miller has. I for one would trust him with crucial government policies.