TwoSheds

More sheds (and tiles) than you, probably

- Joined

- Feb 12, 2014

- Messages

- 13,987

Remember the Tapered Annual Allowance applies so people earning £360k+ per annum still only get tax relief on £10k pension contributions per annum (admittedly up from £4k per annum previously). Between £260k and £360k you "lose" £1 of tax relief for every £2 earned.

It would be very difficult to get tax relief on a pension pot above the £1.073m pre-budget limit whilst only getting relief on £10k per year.

It's a tax cut on the upper middle classes (and middle classes in London) rather than the very wealthy. Although "very wealthy" is subjective of course.

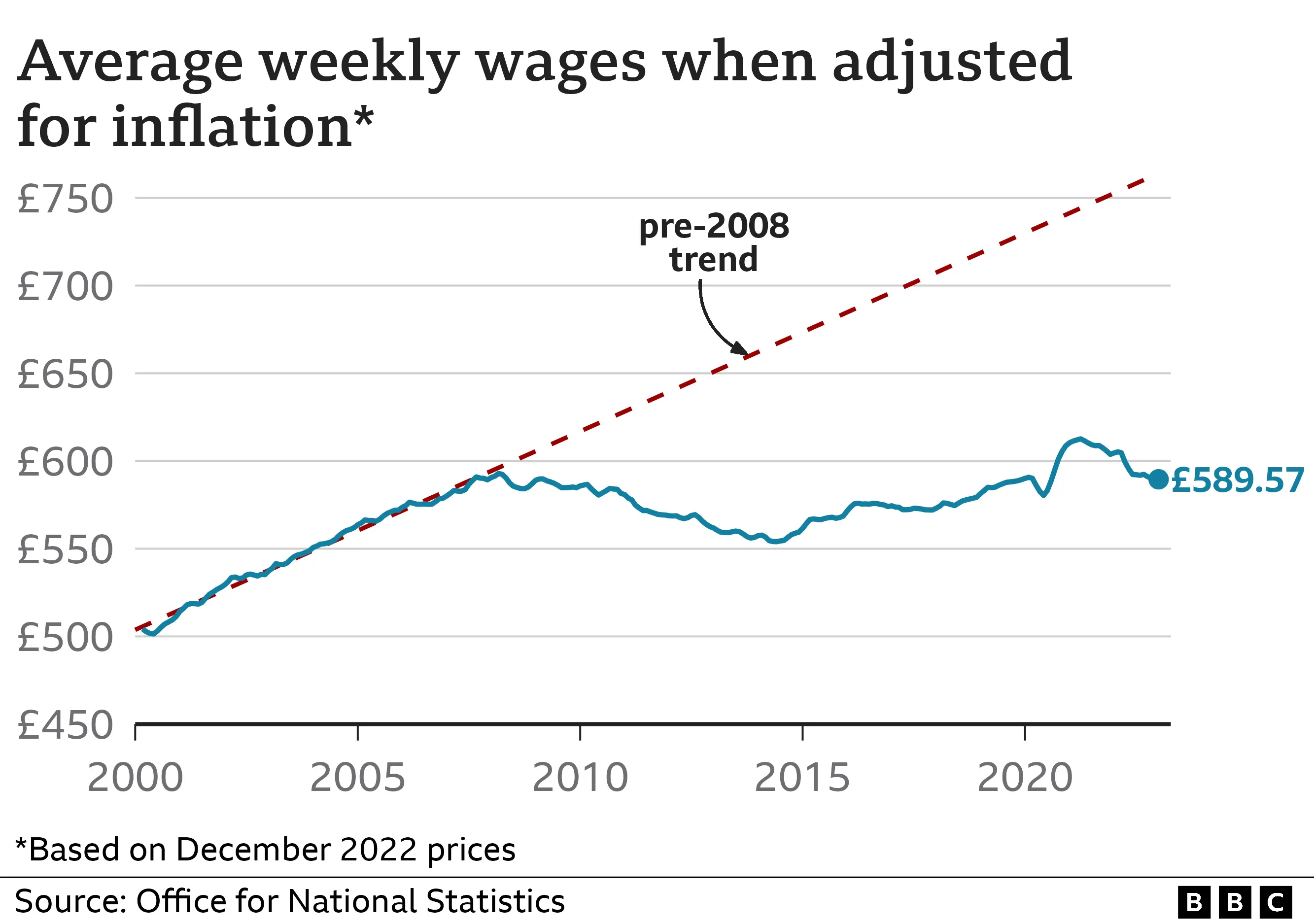

£360k a year is very wealthy and it's a symptom of a broken economic system that that isn't necessarily thought of as being the case. If you're earning 10x the average salary, by anybody's view you should be considered very wealthy. I think when that law was proposed in Switzerland it was that nobody at a company should earn more than 12x what the lowest paid worker earned. I think the more recognised number might be 20x. Either way, you're well on your way towards that.