Fluctuation0161

Full Member

Oh just feck off.

Yes, blind patriotism, we need more of that!

Oh just feck off.

Oh just feck off.

Oh just feck off.

In 2017, Rosindell said: "The humiliation of having a pink European Union passport will now soon be over and the United Kingdom nationals can once again feel pride and self-confidence in their own nationality when travelling, just as the Swiss and Americans can do. National identity matters and there is no better way of demonstrating this today than by bringing back this much-loved national symbol when travelling overseas."[35] It was subsequently revealed that the colour of passports was not a matter controlled by the European Union, while the more general design standards related to the International Civil Aviation Organization, an agency of the United Nations.

Oh just feck off.

I'll never understand British nationalism. I mean, Britain is just objectively a bit shit, isn't it?

Except by then you will be old, and the new young will have principles and ideas you cannot now conceive of.I can’t wait until we outnumber the boomers politically.

Nah. The boomer generation had advantages and benefits that the generations below will never have access to, they’ve pulled the ladder up behind them and wealth and home ownership is now far more concentrated than ever before and it’s only getting worse.Except by then you will be old, and the new young will have principles and ideas you cannot now conceive of.

You're in a doomed generation Pex, politically fecked from both ends.

I’m terms of cultural conservatism, many things which boomers see as progressive, millennials and below think of as completely normal.

You think zoomers are going to go from understanding the complexities of gender and thinking absolutely nothing of it to saying “two genders mate. Adam and Eve”?Probably the same will happen when millennials are older and when same with gen alpha and then with whatever comes two generations after alpha

Nah. The boomer generation had advantages and benefits that the generations below will never have access to, they’ve pulled the ladder up behind them and wealth and home ownership is now far more concentrated than ever before and it’s only getting worse.

As such, I really don’t think we are going to see the same economical conservatism from millennials and below. I’m terms of cultural conservatism, many things which boomers see as progressive, millennials and below think of as completely normal.

Reminds me of my FIL. London fireman by day, bouncer, painter, etc by nighttime and days off, just to make ends meet, and this was from living out of London in KentAs a so called Boomer, I completely disagree that our generation had advantage and benefits later generations did not.

Examples:

Unemployment. This was very high during the 1970's typically being 10%.

House prices. When we were buying our first house, mortgage availably was very low. We had to save with a Building Society and when their allocation ran out, we had to reapply month after month after month. During that time, the price of the house went up by over 50%.

Inflation. This was up to 15%. And I had to work nights and weekends just to pay for the monthly mortgage. And we had to put off having children for a few years.

I would like to know what were those advantages you are referring to?

As a so called Boomer, I completely disagree that our generation had advantage and benefits later generations did not.

Examples:

Unemployment. This was very high during the 1970's typically being 10%.

House prices. When we were buying our first house, mortgage availably was very low. We had to save with a Building Society and when their allocation ran out, we had to reapply month after month after month. During that time, the price of the house went up by over 50%.

Inflation. This was up to 15%. And I had to work nights and weekends just to pay for the monthly mortgage. And we had to put off having children for a few years.

I would like to know what were those advantages you are referring to?

MP for Ipswich Tom Hunt told the Telegraph: "If you've broken the law and committed criminal damage you should be punished. If the jury is a barrier to ensuring they are punished then that needs to be addressed."

As a so called Boomer, I completely disagree that our generation had advantage and benefits later generations did not.

Examples:

Unemployment. This was very high during the 1970's typically being 10%.

House prices. When we were buying our first house, mortgage availably was very low. We had to save with a Building Society and when their allocation ran out, we had to reapply month after month after month. During that time, the price of the house went up by over 50%.

Inflation. This was up to 15%. And I had to work nights and weekends just to pay for the monthly mortgage. And we had to put off having children for a few years.

I would like to know what were those advantages you are referring to?

You're a clued up guy I'm fairly sure you know the figures.

Adjusted wage growth has been on a decline since the 70s but it's the 2010 period that screwed a generation as the drop was substantial and has barely recovered.

Then the house price to wage ratio has risen dramatically since the mid 90s ruling out housing as feasible for many in the above generation that were also hit by recession induced wage stagflation. If they can they're stuck with a huge mortgage over longer periods than ever so more interest and a later retirement age.

I can never understand why boomers have to try and win some sort of competition on this. When we're talking societal level your own experiences don't really come in to it. It's not a personal slight that discredits any personal hardships of your own.

I think it’s actually great in some ways, just not the ways the nationalists imagine it to be.

law and order tories, wanting less of the law and more of the order.I see my MP has been dog whistling to his audience again re: this statue bollocks...

State of it.

Not objectively, utterly and totally.I'll never understand British nationalism. I mean, Britain is just objectively a bit shit, isn't it?

law and order tories, wanting less of the law and more of the order.

As a so called Boomer, I completely disagree that our generation had advantage and benefits later generations did not.

The lack of wage growth has obviously offset the benefit of zero interest rates, while inflation, though low until recently over the last decade, has still nibbled away.

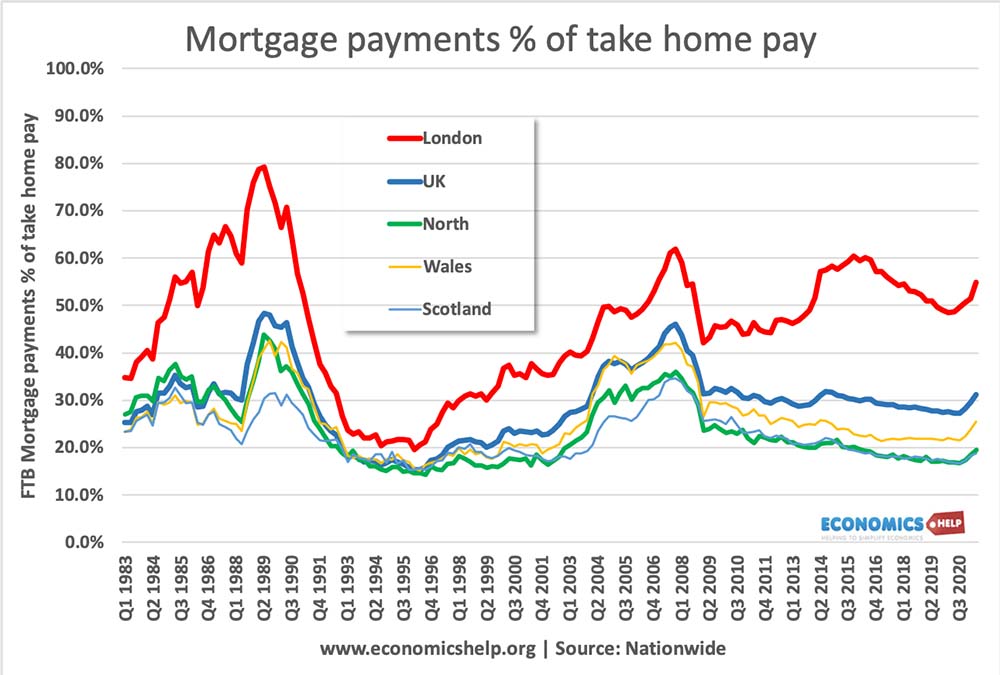

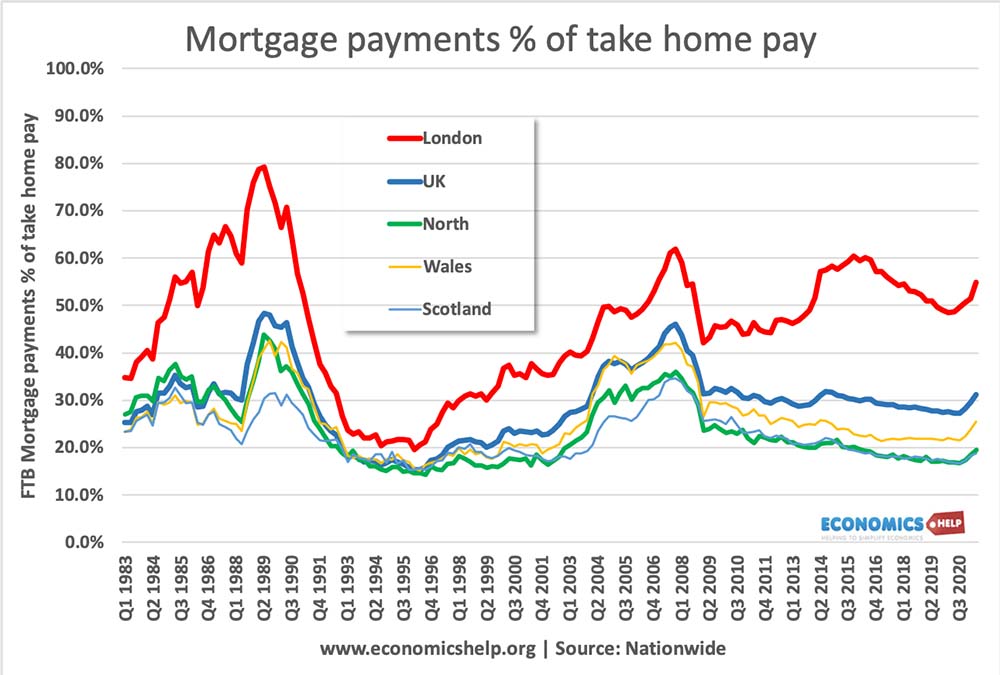

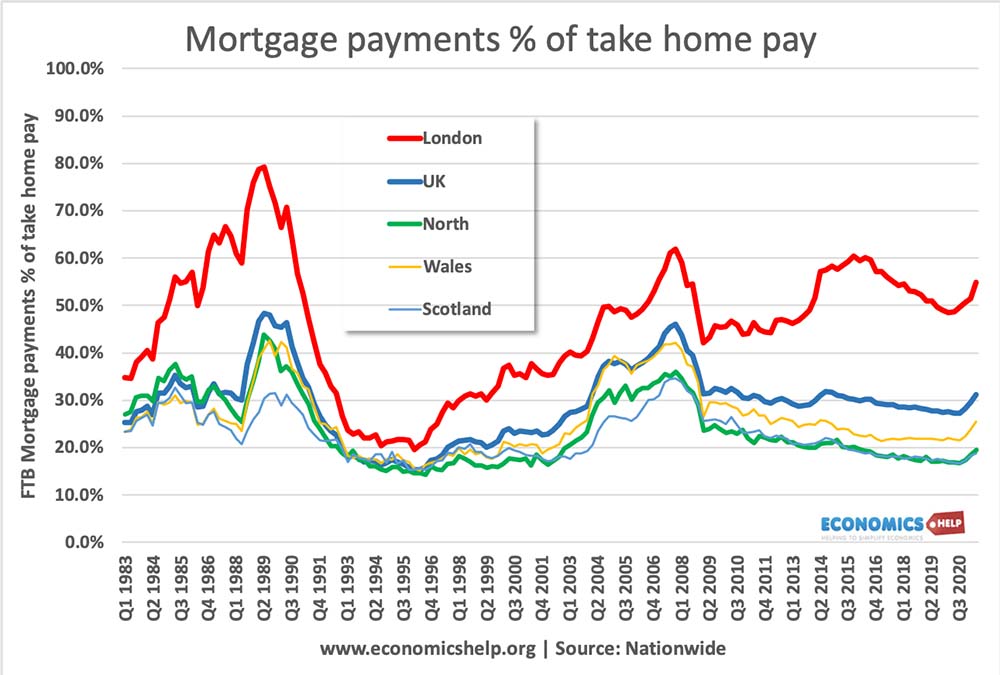

If interest rates shoot up its going to make a big difference - but for sure outside of london the actual % of take home pay that a mortgage costs has not had that drastic a change

House price to wage ratio has for sure shot up - I see pwople are now offering a 7X wage mortgage... when before 2.5X was about the max... but due to the low interest rates the actual real important figure of % of take home pay has remained fairly constant (at least outside london)... the big issues would come if there was a sudden and sustained interest rate rise

though as Ive just fixed for 30 years then yeah fine whatever bring it on

Who knows how future generations will view things. Yours and my generation is set inherit the expensive boomer properties, which will fuel further resentment down the chain.Nah. The boomer generation had advantages and benefits that the generations below will never have access to, they’ve pulled the ladder up behind them and wealth and home ownership is now far more concentrated than ever before and it’s only getting worse.

As such, I really don’t think we are going to see the same economical conservatism from millennials and below. I’m terms of cultural conservatism, many things which boomers see as progressive, millennials and below think of as completely normal.

If its take home pay then income tax rates are taken into account (as is national insurance)The lack of wage growth has obviously offset the benefit of zero interest rates, while inflation, though low until recently over the last decade, has still nibbled away.

You'd need to factor in income tax rates as well.

I missed that it's take home pay. The % of net pay on payments may not have changed much, but the loan to salary ratios are eye-watering. People are more leveraged up now with the amount of credit available, meaning many are very susceptible to rising interest rates.If its take home pay then income tax rates are taken into account (as is national insurance)

tax free allowances were lower in 1980s and 1990s also tax rates were generally higher but as we are looking at net pay the impact here would be on gross pay therefore loan to salary ratio which as I say has been pretty much absorbed by lenders almost tripling that figure

as such when you look at % of net pay on mortgage payments this has remained (london excluded fairly consistent and certainly now isnt dramatically diferent from the mid 1980s for example.

If interest rates shoot up its going to make a big difference - but for sure outside of london the actual % of take home pay that a mortgage costs has not had that drastic a change

House price to wage ratio has for sure shot up - I see pwople are now offering a 7X wage mortgage... when before 2.5X was about the max... but due to the low interest rates the actual real important figure of % of take home pay has remained fairly constant (at least outside london)... the big issues would come if there was a sudden and sustained interest rate rise

though as Ive just fixed for 30 years then yeah fine whatever bring it on

They say you get more right leaning as you get older. I've not, but maybe those not tuned into politics detail do.I can’t wait until we outnumber the boomers politically. What a bunch of absolute cnuts these Tory MP’s are.

Yes but we used to shit on the commonwealth from a great height. We then built them railways so it's OK, apparently.I'll never understand British nationalism. I mean, Britain is just objectively a bit shit, isn't it?

@Buster15

Tell them about living through the ending of rationing.

As a four year old, I clearly remember getting a pack of chocolate biscuits in 1950 from my paternal Grandmother, to celebrate the final WW2 rationing lifted on chocolate biscuits, treacle, jellies and mincemeat... amongst other things.

However I still lived in a two up two down terraced house, until I was eighteen, no bathroom (used slipper baths at local Swimming pool) and an outside loo (in the back yard) brrrr... it was dam cold in winter, made sure you didn't linger too long!!

Helping my dad make a new fire each morning, riddling out the ashes, again cold as refrigerator, although really we didn't know what that was, until a Yank moved into the big house at the end of the street and used to give us to give lollies from his 'ice-box'.

However I was one of the lucky ones that got called into the offices (located over Burtons the Tailors Shop on the High Street) in 1960 of the new Youth Employment Service, who eventually helped me find work at 15 as an engineering apprentice after I'd been walking around company after company knocking on doors and asking 'give us a job' for six months! The pay was £2.3s.6d per week!

I am sure that at sometime in my life I experienced something better than what todays kids get... but it just escapes me for the moment, must be my age!

I can’t wait until we outnumber the boomers politically. What a bunch of absolute cnuts these Tory MP’s are.

Average yearly wage 1970: £1,664

Average house price 1970: £4,975

Average yearly wage 2010: £25,882

Average house price 2010: £167,469

Gosh yeah, I wonder why people complain about Boomer privilege..

Yes thats the risk... though I'm sure the government is aware of that and will make sure the bank of England is given targets that are likley to see low long term interestsI missed that it's take home pay. The % of net pay on payments may not have changed much, but the loan to salary ratios are eye-watering. People are more leveraged up now with the amount of credit available, meaning many are very susceptible to rising interest rates.

Yeah but it's much better now...Average yearly wage 1970: £1,664

Average house price 1970: £4,975

Average yearly wage 2010: £25,882

Average house price 2010: £167,469

Gosh yeah, I wonder why people complain about Boomer privilege..

Yeah but it's much better now...

Average yearly wage 2021: £31,285

Average house price 2021: £269,945

...ah feck. Anyone got a box for sale?!

Easy to save 27k this day and age. Easy.So average salary of couple = 62k... 4x salary (can get more but most main lenders use 4)= 248k

10% deposit = 27k

Total = 275k... should just about cover the stamp duty and conveyancing fees as well

Oh look that seems about right then

So average salary of couple = 62k... 4x salary (can get more but most main lenders use 4)= 248k

10% deposit = 27k

Total = 275k... should just about cover the stamp duty and conveyancing fees as well

Oh look that seems about right then

Or most people used to have one wage winner now they have two so it used to be 3 and a bit times family income now its just under 4 times but interest rates have lowered meaning the net% of wages cost of a mortgage is still about the sameOr house prices used to be roughly 3x average annual salary.

Now it's nearly 9x average annual salary.

"Chicken feed"