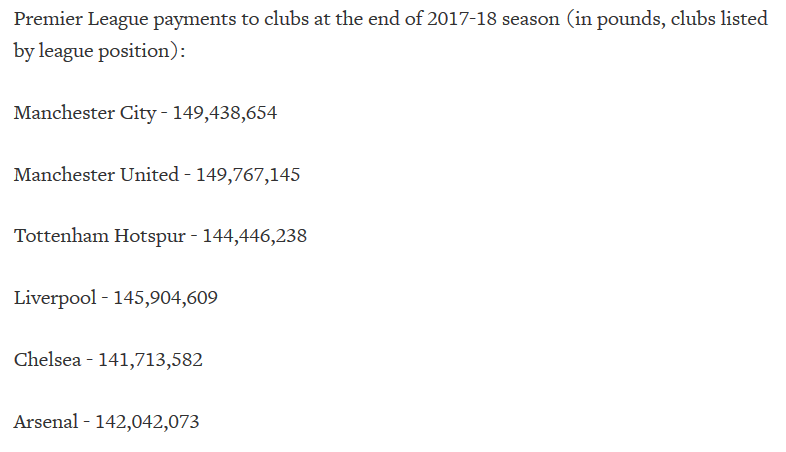

I was looking at the following numbers, which state that even though we finished 2nd in the league, we earned the same amount of money as MCFC (1st place team), last season.

And LFC, who finished 4th, earned only £3.5M less than the league winners.

source

Let's assume that Jose told the board that to win the league we need to (net) spend £250M.

And to get top 4, we need to (net) spend £60M.

This gives a difference of £190M.

So, for us to mount a challenge, we need to spend an extra £190M.

From a business stand-point, why would the Glazers sanction the spending of £190M extra, given that the income from getting 1st place, is only £3.5M extra and won't cover that extra investment?

In other words,

invest £250M to earn £149M - loss of £101M

invest £60M to earn £146M - profit of £86M

Given these numbers, above, this would explain why the Glazers are not spending big.

Worryingly, are we set to become the new Arsenal? Wenger helped make the owners of AFC, huge amounts of money - spending very little, to maintain 4th place and was removed, only when the fans started boycotting games (reduced gate receipts). My suspicion is that this is what the Glazers have been targeting and in Jose, they finally have a manager who can consistently achieve this (Moyes/LVG, previously failed).

So, top 4, CL qualification, with an FA Cup, here and there, could be what Glazers have in mind for MUFC, for the next few years.

For my own sanity, please, somebody convince me using sensible logic, that this is not what is planned for MUFC.