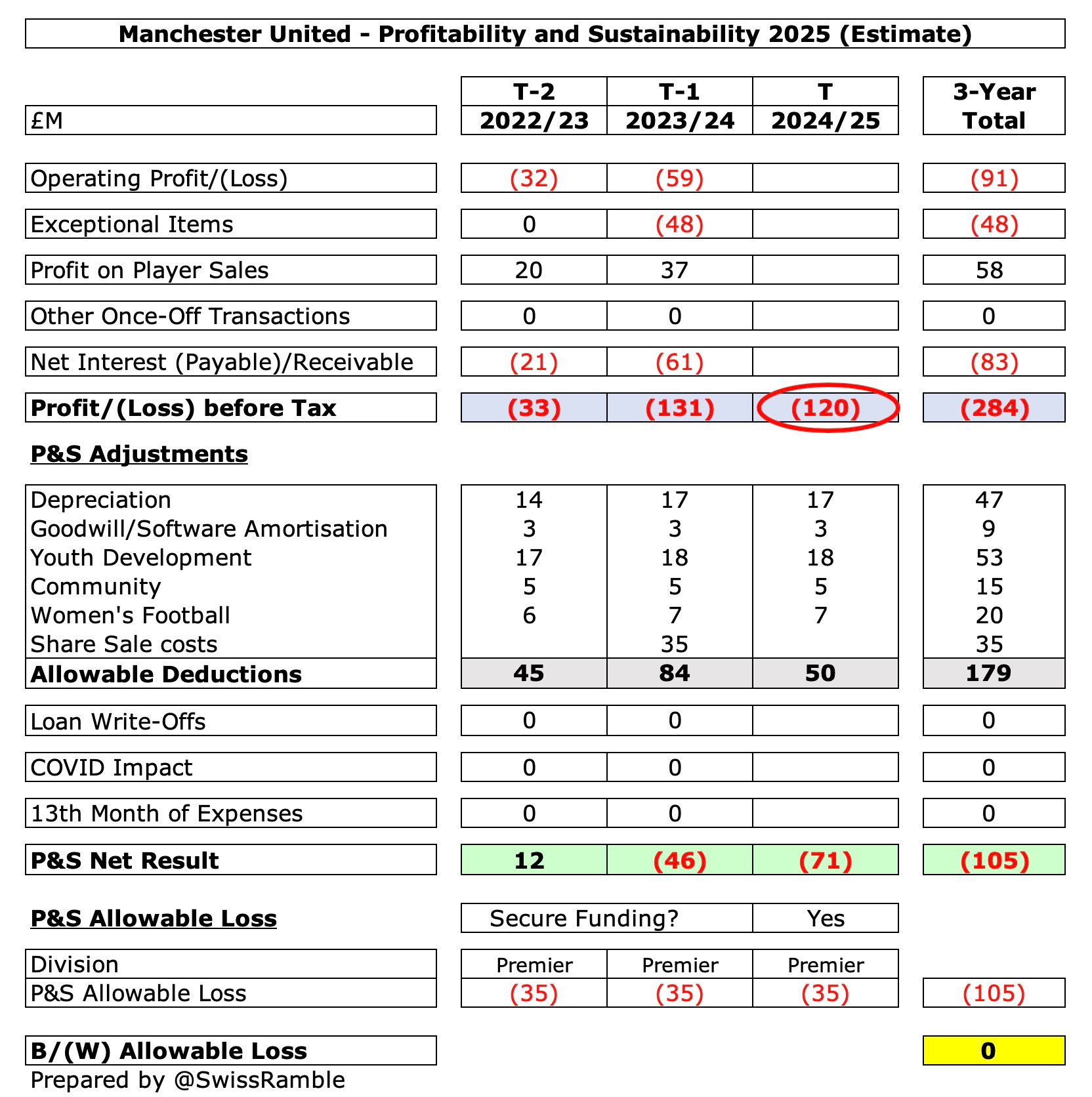

I was actually looking at the club accounts and did some very back-of-an-envelope calculations myself using Swiss Ramble's model to try and figure out where they might be PSR wise for this season at this very early stage, this based off SR's assessment below where he calculated United should be able to lose around £120m in pre-tax profit / loss before they look to be in non-compliance with PSR:

Filling in the blanks using his model I'd worked on the assumption that these might be around the following amounts:

Operating Profit/Loss: -£85m

Swiss Ramble's model takes EBITDA (Earnings Before Interest, Taxation, Depreciation & Amortisation) which I have used as

£145m (taken from club Q1 2025 report where they have outlined expected in range of £145m-160m) and deducts the following:

- Player Amortisation (-£210m) - calculated using the 23/24 total as a base, I've then added amounts for the players signed this summer, then deducted an amount for Fernandes who should have been fully amortised as of last season.

- Depreciation (-£16.5m) - used SR's figure above

- Goodwill Amortisation (-£3m) -used SR's figure above

- Player Impairment (£0m) - put this at zero as it was for the last couple of seasons

Exceptional Items: -£30.5m

- Accounting for the 250 staff redundancies made in the summer (-£8.6m, this is confirmed in the Q1 2025 report) and expected costs for firing Ten Hag (-£10.4m) and hiring Amorim and team (£11.5m).

Profit on Player Sales: +£35.6m

- This is from the Q1 2025 report. As Swiss Ramble noted it looks strangely low considering the players sold like McT, Greenwood, AWB plus the bunch of younger players... he projected this to be around £67m initially. I can't think why other than possibly some of the fees received were not as high as speculated and/or there were players sold like AWB and Donny VDB who had greater remaining amortisation fee reductions than anticipated (which could be the case if the club amortised not over the 5 year contracts they received but over 6 years including the +1 options).

Net Interest Payable - £?

This is the one that's really highly speculative and so hard to put any sort of number on, as based on the club reports this appears to be mainly based FX fluctuations linked to the club's USD borrowing.

If my above calculations are at all correct this would leave a potential of up to

-£40.1m to stay within the -£120m pre-tax profit/loss figure SR mentioned in order to comply with PSR still in the next cycle.

Worth noting that the club paid interest of £60.1m last season and £20.1m in 22/23, this figure would be an average of those amounts so potentially looking at current numbers they are very tight with PSR which would explain why they are in this position where they can't commit to any spending unless they sell players this window.