I'd love to hear some details of our new deal with Chevrolet compared to the one announced by Liverpool this week - I think that would provide an interesting study of how effective is our commercial team: same company, same type of deal, except of course we're so far above Liverpool that anything less than a massively superior deal in our favour would be a disappointment.

Depends on the detail of the deal though and exactly how much exposure is promised to the sponsor, which could be quite different for each club.

If all else was equal, then yes ours would be higher.

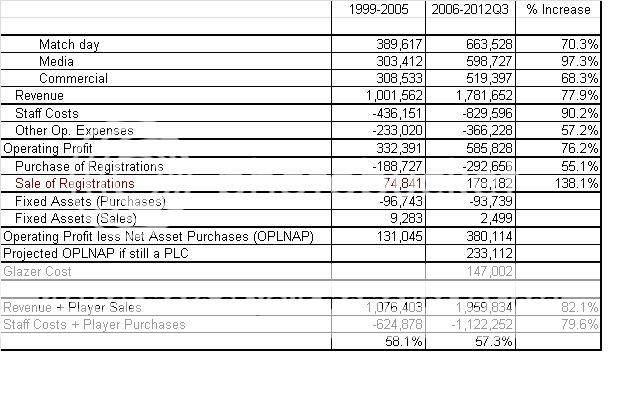

He's like the fecking Wizard of Oz. "Pay no attention to the half a billion pounds the club has paid out to service debt it did not incur itself but through the leveraged takeover by the Glazers". Were the Glazers responsible for United's increase in revenue in the 90s? Was it their divine guidance that allowed SAF to knock Liverpool off their perch?

He's like the fecking Wizard of Oz. "Pay no attention to the half a billion pounds the club has paid out to service debt it did not incur itself but through the leveraged takeover by the Glazers". Were the Glazers responsible for United's increase in revenue in the 90s? Was it their divine guidance that allowed SAF to knock Liverpool off their perch?